Reserved for corporate action positions

Reserved positions due to corporate actions can be for one of the following reasons:

1. Reserved amount - Instruction received

2. Reserved amount - Stock accruals

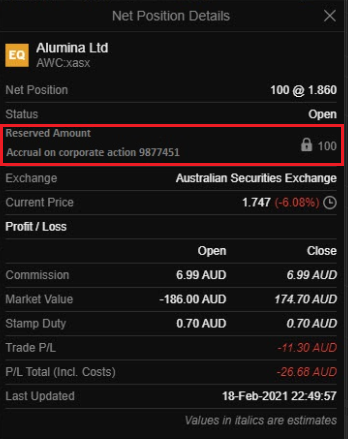

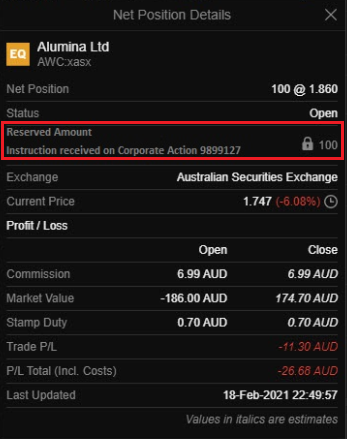

In a trading platform, clients can see a position that reflects “You have a reserved position due to a corporate action” - see an example below.

For a further explanation these can be checked under the position details.

Reserved amount - Instruction received

Corporate action stock may be reserved automatically upon receipt of corporate action instructions, where securities need to be surrendered to participate. This will be based on instructions that have been executed with Saxo Bank under the corporate action module in a voluntary event.

These reserved positions will be identified as “reserved for corporate action” on the clients portfolio and will remain in this status until the proceeds have been received on or after the payment date. Once received the reserved position will be debited and the proceeds credited with an unreserved status.

The number quoted can be checked in the corporate action module and refers to the Event ID (in below example the Event ID number is 9899127).

Reserved amount - Stock accruals

Stock accruals will be reflected so that clients are able to see securities that are due from a corporate action prior to these being paid (realized) on the payment date. Once realized on payment date these will no longer be reflected as reserved positions. The number reflected is an estimate and is subject to change / reversal until the payment date.

The number quoted can be checked in the corporate action module and refers to the Event ID (in below example the Event ID number is 9877451).