Time Weighted Return ("TWR")

To calculate the return in percentage, Saxo applies the standard industry-wide recognized TWR methodology.

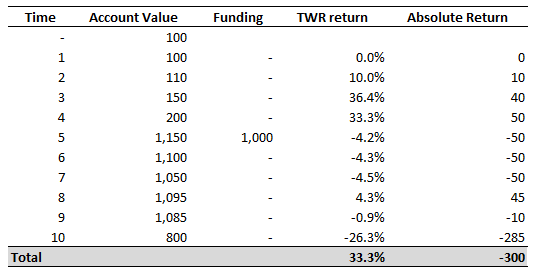

Saxo calculates the TWR as the compounded return of the daily returns, over the respective period being evaluated, e.g. 1 year.

Absolute Return

To calculate the absolute return, we evaluate the Account Value (t+1) vs. Account Value (t), and adjust for any account funding and/or account withdrawals.

Why could there potentially be a conflict between Absolute Return and TWR?

It is important to notice that TWR does not take into consideration the size of the portfolio, when the sub-returns (daily returns) are calculated.

If sub-periods with low account value yield very high positive returns and sub-periods with high account values yield slightly negative returns, you could end up with a high positive TWR for the total period. However, the total Absolute Return might be negative and vice versa.

To illustrative this, please refer to the example below. Note, in this example the TWR is positive (+33%), while the Absolute Return is negative (-300).